Edit: Closed out this trade with DDI trading over $10.15 per share, a 14% gain in less than one month

Summary:

iGaming company with best in class conversion rates

Trading at net cash value, 35% FCF yield

Forced selling creates short term opportunity

Although I’m primarily a long-term investor, I’m not against taking short-term positions when I see an opportunity.

I believe this stock is one of those opportunities.

The following company was already trading at an extremely cheap valuation, and forced selling from a secondary offering created a short-term price drop offering a compelling entry point.

I post about under-the-radar companies trading at extremely cheap valuations. If you are interested in posts like this, Subscribe.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author may own, or plan to purchase, shares in the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

Overview

DoubleDown Interactive (DDI) is a South Korean game developer listed on Nasdaq. The company was founded in 2008 and transitioned to a social casino and gaming focus in 2017, after a majority stake was acquired by DoubleU Games, another Korean gaming firm.

Today, the company operates two business lines:

Social Casino games do not use real money or award real cash prizes, but use fake virtual currency and a “points” system to simulate a gambling environment. DDI pioneered this category with DoubleDown Casino on Facebook in 2010 and has since expanded to mobile and web, creating additional titles such as DoubleDown Slots and DoubleDown Fort Knox.

In October 2023, the company entered into the iGaming space by acquiring SuprNation AB, which operates licensed real-money online casinos in Europe. SuprNation runs platforms like VoodooDreams, NYSpinz, and Duelz, where users bet real money and can win cash prizes.

With this acquisition, DDI now owns 3 licensed iGaming platforms in Malta, Sweden, and Great Britain.

Business Model

The company runs a proven freemium model for its social casino games.

Customer acquisition is primarily driven through paid social media ads on Google and Facebook.

Once inside the app, users are engaged with highly gamified, casino-style experiences using virtual “coins.”

Players start with free chips but must either wait, watch ads, or make in-app purchases (IAP) to continue playing.

Social Gaming monetization comes from 2 sources:

In-app purchases (IAP), where users can purchase virtual chips or remove ads

Advertising revenue, from incentivized video ads that users watch to earn free chips

This business generates very high cash margins because virtual chips have no cost to produce, so once customer acquisition costs are covered, incremental revenue is almost pure margin.

As in most social casino models, 2-5% of players generate the vast majority of revenues, while the remaining ~95% of users never spend real money.

DDI has outperformed peers in converting free users to paying customers, with a Payer conversion rate of 6.9% in Q1 2025. This is well above the industry average of 2-5%

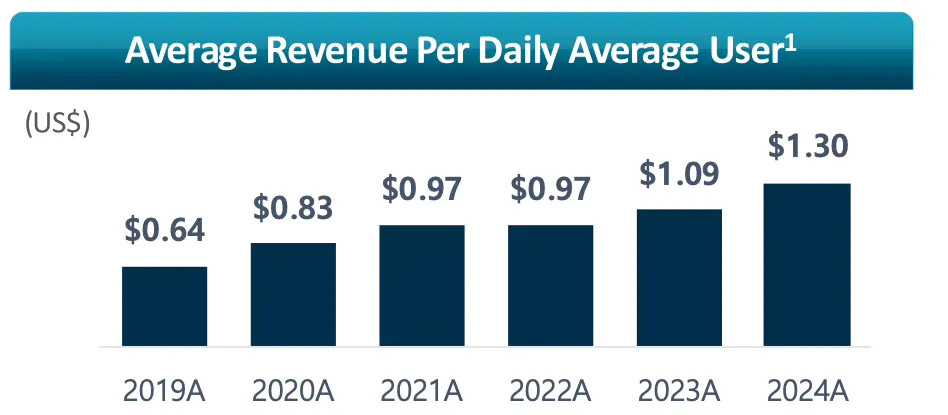

In the quarter, ARPDAU (Average Revenue Per Daily Active User) was $1.29, well above the industry average of $.50-$1.00 for social casino games.

Although the number of monthly active users (MAUs) has steadily declined since going public in 2021(Likely a contraction from Covid-driven gaming demand), DDI has effectively been able to monetize their user base and increase their performance indicators every year since 2019.

The company’s ability to produce higher revenue per user compared to peers comes down to their data-driven approach to the business.

What allows DDI to perform this well is their 10+ years of proprietary data analytics infrastructure, enabling precise player segmentation, targeting, and user acquisition optimization. This data-driven model gives DDI a competitive edge in user monetization and acquisition efficiency.

This is a competitive advantage for the company, as higher revenue per user means the company can spend more on customer acquisition while still remaining profitable.

iGaming Transition

In October 2023, DDI acquired SuprNation for $36.5M. This valued the business at 1.3x sales, a very good price compared to comps at 2-4x sales.

It appears the company has been able to apply their best in class data analysis systems towards the SuprNation platform, as revenues from this segment grew 39% in 2024.

Today, this segment represents ~16% of total revenue. While still a small contributor, management has made clear it intends to expand via acquisition into Italy, France, Germany, and Spain. The company’s $380 million in net cash gives them the opportunity to make a large acquisition should the opportunity present itself.

While lack of shareholder returns is frustrating, this strategy could pay off if DDI continues to acquire high-quality iGaming platforms and scale them efficiently with their in-house analytics systems. If successful, the market could begin to value them as a fast growing iGaming company that commands much higher multiples compared to a traditional mobile gaming developer.

Catalyst

Last week provided investors an opportunity to purchase this business at a compelling valuation.

On June 12th, a major shareholder (STIC Special Situation Diamond Ltd.) sold 4.3M ADS in a secondary offering at $8.50, well below the market price of $10.68.

Due to the stock’s limited liquidity a large sale required a discount. Though this event had no impact on DDI’s underlying financials, it triggered a 24% price drop to $8.15.

The stock has since recovered modestly, but at the current price of $8.87, it remains well below the pre-offering price, creating an attractive short-term setup.

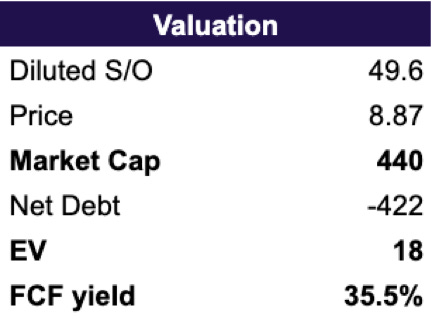

Here is the current valuation of the business:

DDI’s net cash is 96% of the current market cap. DDI is also trading at <3x FCF (35% FCF yield). This is an extremely low valuation for a company that consistently generates stable free cash flow. At this rate, at the same valuation the company will be trading below net cash by next quarter.

Risks

There are several risks that could explain the valuation:

Lack of capital returns - at this valuation, the obvious way to create immediate return to shareholders and stock price appreciation would be to return capital either through buybacks or dividends.

However, I do not expect management to do this for a couple reasons.

Korea’s corporate culture, like Japan’s, tends to be conservative and prioritizes survival over maximizing shareholder returns.

More importantly, 67% of shares are held by DoubleU Games, another Korean gaming company. It is clear they do not care about shareholder returns and are taking an “empire building” approach to make the company as large possible revenue/size wise, even if this results in subpar performance from an investment perspective.

Low float/no shareholder activism - 96% of the stock is tightly held between DoubleU Games and private equity firms. This leaves no room for activist investment or outside influence.

Legal Risks - Although DoubleDown Casino operates as a social casino and does not host real money gambling or award cash prizes, the company has still been involved in a number of lawsuits.

In 2018, the company faced a major class action in Washington State, alleging its social casino games violated local gambling laws.

DDI settled in 2022 for $145 million of a $415 million joint settlement with former parent company IGT.

There are still three ongoing lawsuits with the risk DDI will have to pay additional legal fees or settlements.

Competition - The mobile gaming market is extremely competitive with many larger public companies operating in the same space as DDI. There is low barrier to entry in mobile gaming, with individual developers able to create their own games that compete on the app store.

Declining MAUs - A continued decline in active users, especially paying users, would adversely impact cash generation.

Acquisition Risk - Management has stated they intend to pursue another large iGaming acquisition.

A poorly executed deal could jeopardize the company’s cash reserves, which provide the margin of safety for the investment thesis.

That said, the SuprNation acquisition has performed well and and management’s patience in pursuing their next deal suggest they’re willing to wait for the right opportunity to come along.

Conclusion

Many will argue this is a typical value trap, where there is no price worth buying if management refuses to return cash to shareholders.

I agree it is a shame to do anything with the cash other than massive dividends and buybacks at this level.

However, I don’t think they need to for this to work out.

I just think a high quality business such that can consistently generate cash shouldn’t be trading at net cash value.

I think the stock will soon return to the pre- announcement price of $10.68 which would generate a quick 15-20% return.

Although not likely, there is easy opportunity for additional upside from management deciding to returning capital in any way to shareholders.

Disclaimer: The information provided in this article is for informational purposes only and should not be considered investment advice. Investing involves risk, including the potential loss of principal. The author may own, or plan to purchase, shares in the security discussed. The author is not a registered investment advisor and does not provide personalized investment advice. Always conduct your own research and consider your investment objectives and risk tolerance before making any investment decisions. The author and publisher shall not be liable for any actions taken based on the information provided in this article.

Thank you for writing this up. Interesting situation. Bit of a weird ownership structure here, just want to make sure I understand it. There is a Korean listed public co (192080.KS) that owns ~66.7% of the US listed ADS shares and effectively controls everything? Weird that they purchased additional shares from the special sits fund in 2021 but did not in 2025. A little unclear how the cash flows between entities because 192080.KS does indeed pay an annual dividend but $DDI does not.

Thoughts on their recent acquisition of WHOW Games for 55 Million?